Swedish Services

Accounting in Sweden starting fee

Fully automized service that tracks your results in real time, gives you access to everything you can dream of and offers full-time support from our professional team.

Annual Income Declaration

Every company conducting business in Sweden needs to submit the annual income declaration within six months of the end of the financial year. It has to be submitted in Swedish and in the currency officially applicable (SEK)

Annual Report – Sweden

Every company registered in Sweden has to submit annual report to the Commercial Register within seven months of the end of the financial year. It has to be prepared in Swedish and in the currency officially applicable in Sweden (SEK)

Changing business information in the Swedish commercial registry

Any changes regarding your Swedish company information have to be done in the Swedish commercial registry. We offer the service to make various changes with your company information in the registry. The service includes drafting and submitting the company documents and the state fee.

EU Trademark Registration

Protect your brand and business interests in the EU and register a trade mark today!

Establishing a branch of a foreign company (state fee included)

Establishing a Swedish branch of a foreign company is a flexible option for expanding business or conducting long-term projects in Sweden.

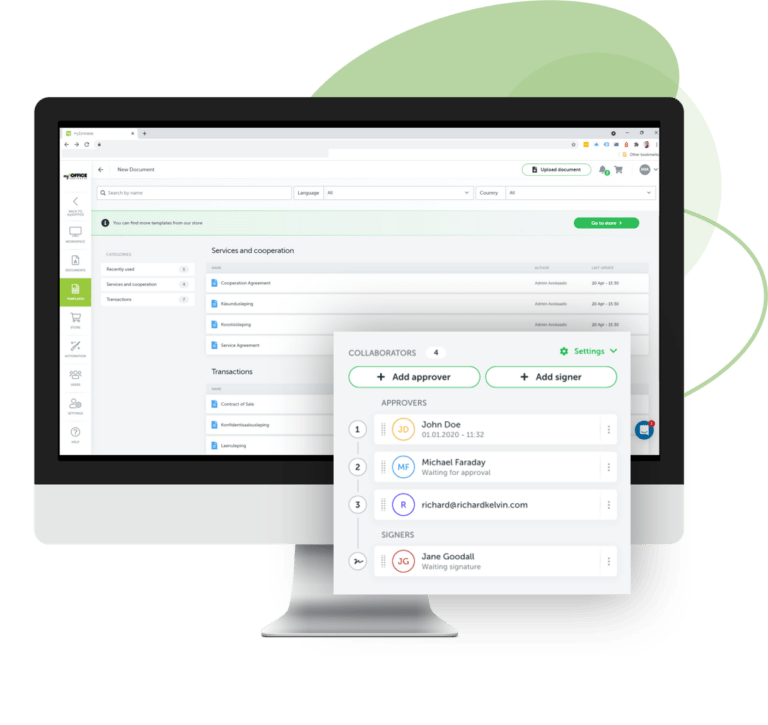

MyContracts, 7-day free trial

Drafting legal documents take too long time? Do you want to have a better overview of your business contracts? These questions are very common in small and medium enterprises. If you are looking for a better way to control your contract lifecycle then look...

Residency requirement exception application

If one of the Swedish public limited company's board members, substitute members, persons with signature rights, a managing director, or a managing director of a branch registered in Sweden is not an EEA resident, then a residency requirement exception application has to be submitted.